Jakks Pacific has reported its financial results for the third quarter, ended 30 September, 2023, with the highest level gross margin of 32+% since 2011.

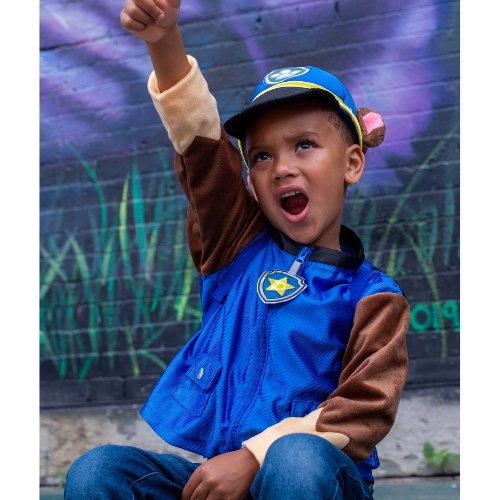

Overall net sales for the period were $309.7 million, a decrease year-on-year of 4%. Meanwhile, costume sales for Q3 were $63.7 million, an increase of 19% year-on-year. Costume sales year-to-date are $122.3 million, a year-on-year decrease of 9%.

Overall gross profit for Q3 was $107 million, up 16% compared to $91.9 million in Q3 2022.

Stephen Berman, ceo of Jakks Pacific, commented: “Although we have seen activity at retail slowing, our business continued to perform well throughout the third quarter. Retail sell-through at our top three accounts in the US were down low single digits on a year-to-date basis, while our inventory at those accounts is down over 20% year-over-year.

“A more predictable supply-chain and lower promotional activity than last year has resulted in significantly improved product margins, building on the continued rigor and collaboration between our development and sourcing teams. We are looking forward to the holiday season and have recently finished great customer meetings previewing our fall 2024 product line. We are exceeding our own internal expectations for the full-year and are carefully navigating towards the end of the year given the persistent uncertainty about consumer behaviour.

“Also in the quarter, we saw our costumes business seasonality returning to more traditional levels and catching up on a year-to-date basis. Although down 9% in year-to-date shipping vs. 2022, globally, we remain +24% vs. the same period in 2021, along with significantly improved margins. Our view of 2023 Halloween shopping in the US was that it was a bit softer overall. We see that in our data and in referencing syndicated market data. The latter suggests we have retained and expanded our market leadership position, but final syndicated data won’t be available until later this month.

“Finally, during the third quarter, we officially opened our new office and internally operated warehouse in Italy to better serve that market and Southern Europe broadly starting in 2024. We are very focused on maximising our presence across the EU given the current strength of our product line.

“It is gratifying to see the team continue to deliver exceptional, consistent results. Everyone in our company remains 100% focused on delivering great toys, costumes and other consumer products relevant to today’s children. Our evergreen category assortment and product lines have never been stronger, which continue to enhance our financial position and resilience.”